Understanding the Significance of Investing Off Shore for Wide Range Diversification

Offshore investing plays a considerable role in riches diversification. It enables individuals to use a broader range of global markets and financial investment possibilities - Investing Off Shore. This approach can efficiently alleviate threats connected to residential economic unpredictabilities. In addition, overseas financial investments may give regulatory and tax obligation benefits. Nevertheless, several stay unaware of the complexities and subtleties included. Recognizing these components is vital for any individual considering this approach for their economic future. What elements should one take into consideration prior to starting?

The Principle of Offshore Spending

Offshore investing describes the technique of positioning possessions in financial markets outside one's home country, commonly to accomplish better economic protection and diversity. This strategy allows firms and individuals to gain access to numerous global markets, potentially gaining from various financial climates, money values, and investment opportunities. Financiers may choose offshore make up reasons such as regulatory advantages, tax obligation benefits, or privacy protection.The concept includes a series of financial investment automobiles, including stocks, bonds, realty, and common funds, readily available with foreign banks. Furthermore, offshore investing can assist mitigate risks related to residential market changes. By spreading out financial investments internationally, individuals can possibly safeguard their riches versus political or economic instability within their home nation. Overall, offshore investing acts as a critical approach to improve economic portfolios, offering accessibility to a wider range of properties and opportunities past regional markets.

Benefits of Diversifying Your Investment Profile

Risk Mitigation Approaches

Just how can capitalists successfully manage risk while making the most of returns? One crucial technique is property allowance, which includes distributing investments throughout various possession courses to decrease exposure to any type of single danger. Investors can expand geographically by consisting of offshore properties, which frequently act differently than domestic financial investments, thus minimizing total portfolio volatility. Additionally, incorporating alternative investments, such as actual estate or assets, can give added risk reduction. On a regular basis rebalancing the profile ensures that possession allowances remain aligned with threat tolerance and investment goals. Additionally, recognizing market fads and economic indications can aid capitalists anticipate adjustments and change their portfolios appropriately. Ultimately, a well-structured financial investment strategy stresses diversity, intending to balance potential returns with acceptable degrees of risk.

Money Diversification Advantages

Capitalists that include currency diversity right into their profiles can improve their potential for returns while lowering direct exposure to regional financial changes. By holding possessions in multiple money, they can take advantage of on beneficial currency exchange rate movements and minimize losses from money depreciation in their home market. This technique not just spreads threat but additionally opens up opportunities for financial investment in arising markets, which might supply higher growth capacity. Additionally, currency diversification can function as a bush against inflation and political instability, offering a barrier throughout financial recessions. On the whole, this method promotes a more durable financial investment portfolio, enabling capitalists to browse international markets with greater flexibility and confidence, inevitably leading to improved long-lasting monetary stability.

Lowering Risk With Geographical Diversification

Geographical diversity uses considerable advantages by spreading out investments throughout various areas and markets. This strategy helps decrease threats related to economic instability, as slumps in one location may be countered by development in one more. Additionally, investing in arising markets can offer distinct opportunities for higher returns and additionally boost portfolio resilience.

Benefits of Geographical Diversification

Why should one think about geographical diversification as a technique for danger reduction? Geographical diversification enables financiers to spread their properties across different nations and regions, minimizing the impact of localized financial downturns. By spending in numerous markets, one can benefit from different growth cycles, currency activities, and market characteristics. This approach lowers dependence on a single economy, which can be at risk to political instability or all-natural disasters. Furthermore, geographic diversity can boost profile efficiency by using emerging markets with high development potential. It gives a barrier versus rising cost of living prices that might vary by region, guaranteeing that the total worth of financial investments stays secure. Inevitably, geographical diversification is a prudent technique for protecting riches versus unforeseeable worldwide events.

Reducing Economic Instability Dangers

Economic instability can position considerable hazards to financial investment profiles, making it imperative to embrace approaches that reduce these dangers. One reliable technique is geographical diversification, which entails spreading financial investments throughout numerous regions and countries. By assigning properties in various economic environments, capitalists can reduce their direct exposure to local financial downturns. If one nation deals with an economic downturn, financial investments in various other regions may continue to be steady or even prosper, offering a buffer versus possible losses. Furthermore, investing in multiple currencies can better shield versus money variations and inflation threats. On the whole, minimizing financial instability risks through geographic diversification not just enhances resilience but likewise positions investors to seize opportunities in numerous markets, eventually cultivating long-lasting monetary security.

Investing in Emerging Markets

Buying arising markets provides a calculated avenue for decreasing threat through geographic diversification. These markets, typically characterized by rapid growth and advancing economic landscapes, can offer one-of-a-kind chances that are much less associated with established markets. By alloting resources to nations with expanding and blossoming markets customer bases, investors can alleviate the effect of localized financial slumps. Furthermore, arising markets may show greater development possibility, enabling financiers to maximize positive demographic fads and boosting international demand. Nonetheless, it is vital to recognize the fundamental dangers, including political instability and money fluctuations (Investing Off Shore). A well-researched and well balanced strategy enables financiers to harness the benefits of emerging markets while effectively taking care of potential downsides, ultimately enhancing their overall profile strength

Accessing Emerging Markets and Opportunities

As global markets progress, accessing arising markets provides a compelling method for wide range diversity. These markets typically reveal fast development possibility, driven by boosting consumer need and technological advancements. Capitalists can take advantage of sectors such as modern technology, renewable resource, and facilities, which are critical in driving financial growth in these regions.Strategically investing in emerging markets enables financiers to maximize favorable demographics and rising middle-class populations. This produces distinct chances for businesses to prosper and, consequently, for financiers to benefit from substantial returns. Furthermore, emerging markets regularly exhibit reduced correlations with established markets, offering a barrier against volatility.To successfully accessibility these chances, financiers can use numerous vehicles, consisting of exchange-traded funds (ETFs), shared funds, and straight equity investments. By diversifying their profiles via emerging markets, investors can improve their total risk-adjusted returns while placing themselves advantageously in a continuously altering international landscape.

Money Protection and Hedging Approaches

Legal Considerations and Compliance in Offshore Spending

Steering with the complexities of overseas investing requires a keen understanding of the lawful landscape and compliance demands that vary by territory. Capitalists should completely comprehend guidelines concerning international investments, taxes, and reporting commitments to ensure compliance with both regional and worldwide regulations. Lots of countries have details legislations controling the establishment of overseas accounts and entities, which can include stringent Know Your Consumer (KYC) and Anti-Money Laundering (AML) regulations.Furthermore, financiers should beware about potential legal challenges, including tax evasion or inadvertent offenses of securities legislations. Involving with trusted legal experts or financial consultants knowledgeable about overseas policies is important to navigate these intricacies. In addition, staying informed regarding adjustments in regulations and legislations is vital, as non-compliance can cause extreme charges. Inevitably, a detailed understanding of legal factors to consider warranties that offshore investments contribute favorably to wide range diversity without sustaining lawful repercussions.

Steps to Get Started With Offshore Investments

Many capitalists looking for to diversify their wide range might locate the process of starting offshore financial investments both satisfying and challenging. The first action involves complete research to recognize suitable offshore jurisdictions that align with financial investment objectives and supply favorable guidelines. Following this, investors ought to pick a respectable monetary establishment or financial investment company experienced in offshore investments. Opening an offshore account is important, requiring the submission of personal identification and conformity documents.Next, financiers should evaluate different investment alternatives, such as property, mutual funds, or stocks, making sure they straighten with danger tolerance and economic goals. Consulting with legal professionals or monetary blog advisors can give useful understandings into the intricacies of offshore financial investments. Ultimately, routine tracking and re-evaluation of the investment profile are vital to adjust to market changes and ensure peak efficiency. By complying with these actions, investors can efficiently navigate the overseas read what he said investment landscape.

Often Asked Inquiries

What Kinds of Assets Can I Purchase Offshore?

The existing question explores numerous overseas financial investment options. People can consider possessions such as realty, common funds, stocks, bonds, rare-earth elements, and cryptocurrencies, each offering distinctive advantages depending upon individual economic objectives and risk tolerance.

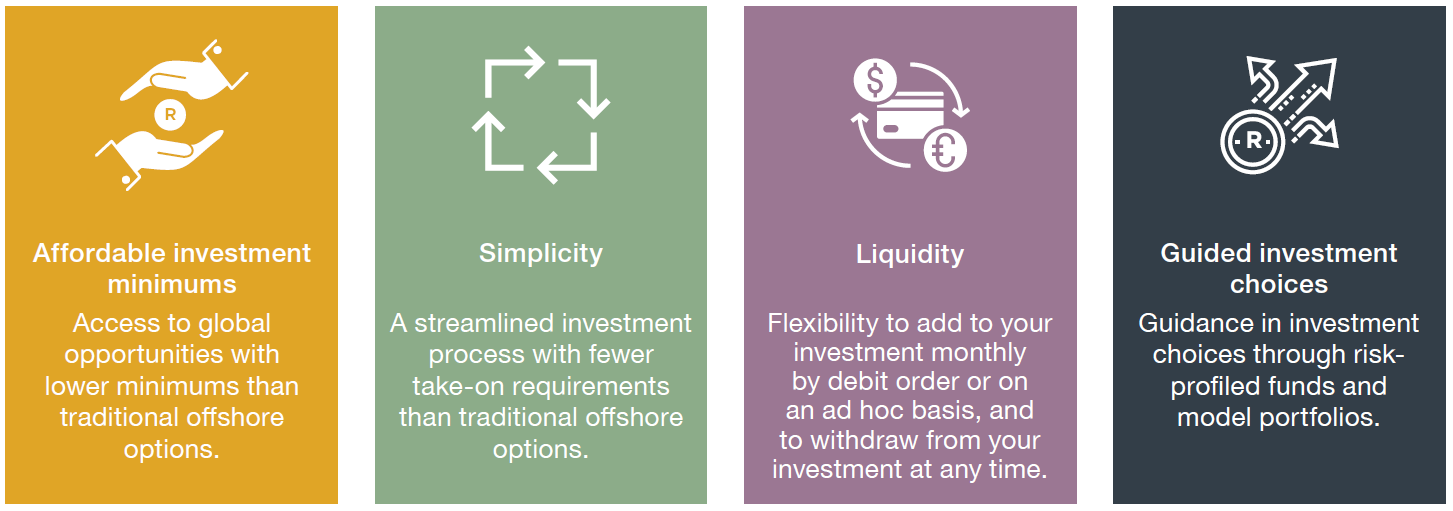

Exist Minimum Investment Amounts for Offshore Accounts?

Minimum investment quantities for offshore accounts vary considerably depending upon the institution and kind of account. Some require as little as a few thousand dollars, while others might state higher thresholds for premium services and investment opportunities.

Just How Do Taxes Service Offshore Investments?

Tax obligations on overseas investments vary by territory and the financier's home nation. Normally, revenue created might go through tax locally, while some countries might use tax obligation motivations or exceptions for certain overseas accounts.

Can I Take Care Of Offshore Investments From Another Location?

Taking care of offshore investments from another location is indeed feasible. Several banks provide on the internet systems, making it possible for investors to check and transact perfectly from anywhere, given they abide by regulative needs and comprehend the connected dangers and fees.

What Are Common Misunderstandings Regarding Offshore Spending?

Typical mistaken beliefs regarding overseas investing include the idea that it is solely for the wealthy, naturally illegal, or excessively made complex. Actually, it can be available, lawful, and workable for numerous capitalists looking for diversification. By spreading investments throughout various possession courses and geographical regions, investors can protect themselves against market you could check here volatility and currency variations. Geographic diversity provides substantial benefits by spreading financial investments across numerous regions and markets. Additionally, emerging markets regularly exhibit lower relationships with developed markets, providing a barrier versus volatility.To successfully access these opportunities, investors can utilize different lorries, consisting of exchange-traded funds (ETFs), mutual funds, and direct equity financial investments. Following this, investors must select a credible economic institution or investment company experienced in overseas financial investments. Regular surveillance and re-evaluation of the investment portfolio are important to adjust to market adjustments and guarantee peak performance.